What’s Really Happening with Mortgage Rates?

Are you experiencing uncertainty regarding the current status of mortgage rates? This confusion may stem from conflicting information, as you may have heard one source claiming rates are decreasing while another suggests an increase. Such discrepancies can leave you puzzled, questioning which information is accurate.

The key to understanding lies in the timeframe considered by different sources. This article aims to provide information that clarifies the confusion surrounding mortgage rates.

Mortgage Rates Are Volatile by Nature

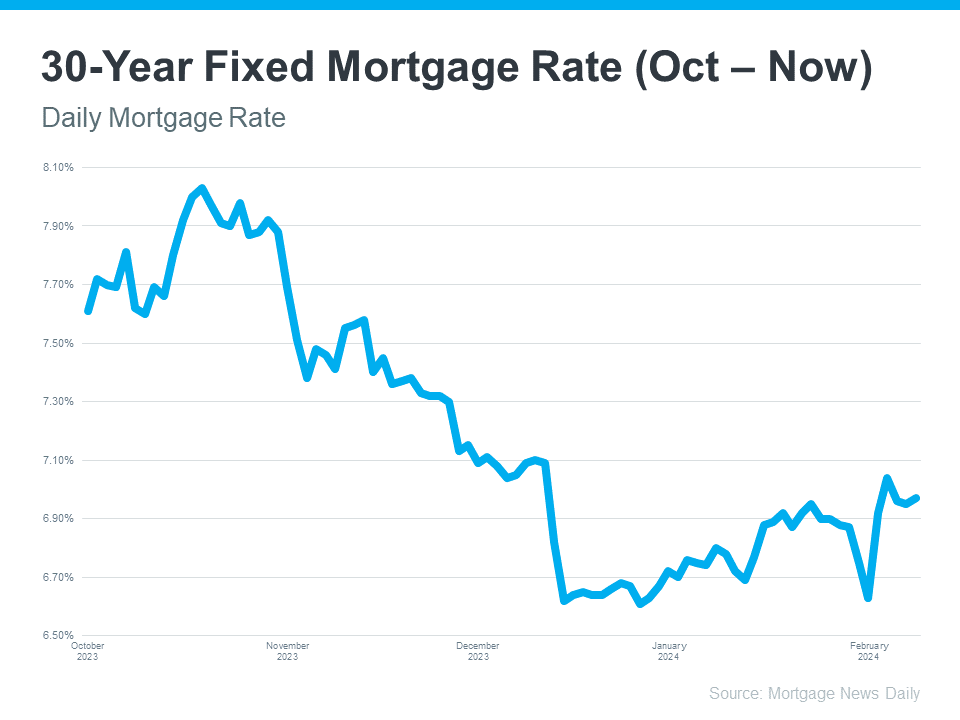

Mortgage rates exhibit a non-linear trajectory, influenced by numerous factors that prevent a straightforward progression. Economic conditions, decisions made by the Federal Reserve, and various other elements contribute to the fluctuations in rates. Consequently, rates can fluctuate, experiencing an upward trend one day and a downward shift the next, contingent on the prevailing economic circumstances and global events. It uses data from Mortgage News Daily to show the ebbs and flows in the 30-year fixed mortgage rate since last October: (see graph below)

Upon examining the graph, you’ll notice numerous peaks and valleys, with variations in their magnitudes. Utilizing such data to clarify the ongoing trends yields different narratives depending on the specific points selected for comparison within the graph.

For instance, by focusing solely on the data from the beginning of this month until now, one might conclude that mortgage rates are experiencing an upward trajectory. However, considering the latest data point and comparing it to the peak in October reveals a downward trend in rates. This prompts the question: what is the correct perspective to adopt when analyzing this data?

The Big Picture

Mortgage rates inherently flucuate, and this is a natural aspect of their dynamics. It’s important not to overly fixate on minor daily shifts but, instead, gain a comprehensive understanding of the broader pattern. To grasp the overall trend, take a step back and examine the larger context.

When comparing the peak point in October to the current rates, there is a noticeable decline from the previous year. This significant information holds substantial importance, especially for prospective homebuyers. It’s crucial to avoid getting sidetracked by minor fluctuations. Experts concur that, on the whole, the substantial downward trend observed could persist throughout the remainder of the year.

Bottom Line

Let’s connect if you have any questions about what you’re reading or hearing about the housing market.