The Truth About Down Payments

If you’re considering the purchase of your first home, the task of accumulating funds for various expenses may seem overwhelming, particularly when it comes to the initial down payment. This might be attributed to the common belief that setting aside 20% of the home’s total cost is mandatory. However, it’s important to note that this is not always the required scenario.

Unless specified by your loan type or lender, it’s typically not required to put 20% down. That means you could be closer to your homebuying dream than you realize.

As The Mortgage Reports says:

“Although putting down 20% to avoid mortgage insurance is wise if affordable, it’s a myth that this is always necessary. In fact, most people opt for a much lower down payment.”

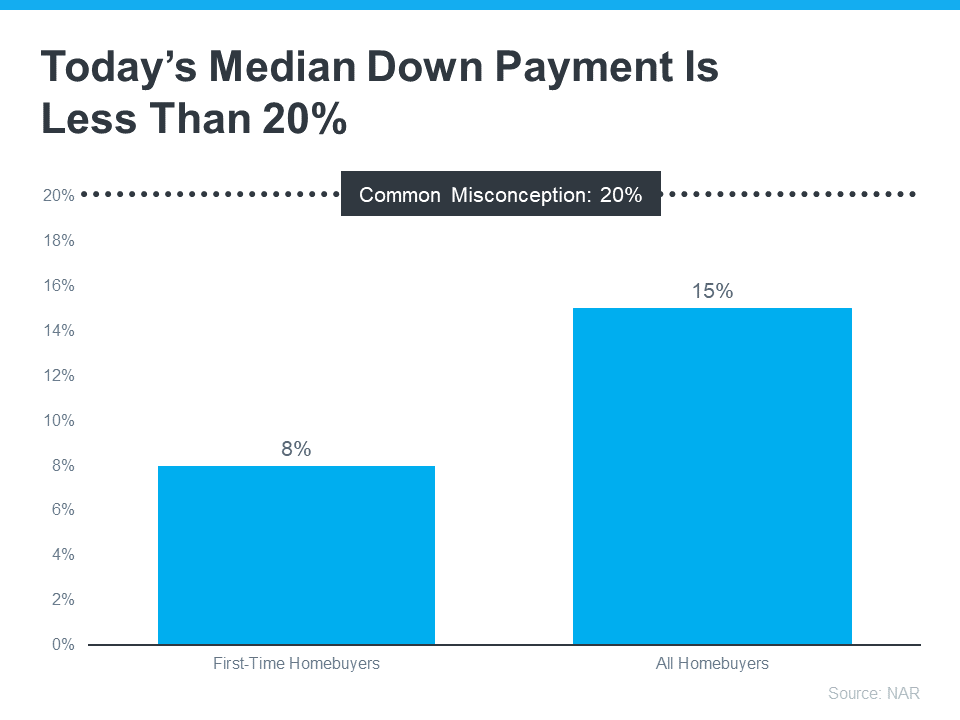

According to the National Association of Realtors (NAR), the median down payment hasn’t been over 20% since 2005. In fact, for all homebuyers today it’s only 15%. And it’s even lower for first-time homebuyers at just 8% (see graph below):

The big takeaway? You may not need to save as much as you originally thought.

Learn About Resources That Can Help You Toward Your Goal

According to Down Payment Resource, there are over 2,000 homebuyer assistance programs across the United States, many of which are designed to provide support specifically for down payments.

Furthermore, various loan options are available to assist in this regard. For instance, FHA loans offer down payments as low as 3.5%, and VA and USDA loans don’t have any down payment requirements for eligible applicants.

Given the multitude of resources aimed at aiding with down payments, the most effective approach to determine your eligibility is by seeking guidance from your loan officer or broker. They possess information about local grants and loan programs that could offer assistance.

It’s essential not to be deterred by the misconception that a 20% savings is mandatory. If you’re prepared to embark on homeownership, rely on the expertise of professionals to identify resources that can turn your aspirations into reality. Delaying your plans until you’ve saved 20% might incur additional costs in the long term. According to U.S. Bank:

“. . . there are plenty of reasons why it might not be possible. For some, waiting to save up 20% for a down payment may “cost” too much time. While you’re saving for your down payment and paying rent, the price of your future home may go up.”

Home prices are predicted to continue to appreciate in the next five years. This implies that the longer you postpone your home purchase, the more likely it is that the future value of your prospective home will increase. By leveraging available resources to make a purchase now, you stand to benefit from the growth in property value, allowing you to build equity instead of incurring higher costs.

Bottom Line

Keep in mind that you don’t always need a 20% down payment to buy a home. If you’re looking to make a move this year, let’s connect to start the conversation about your homebuying goals.