The Perks of Buying over Renting

Buying a home can indeed be a wise decision for several reasons, despite fluctuating mortgage rates. Here are two solid reasons to consider:

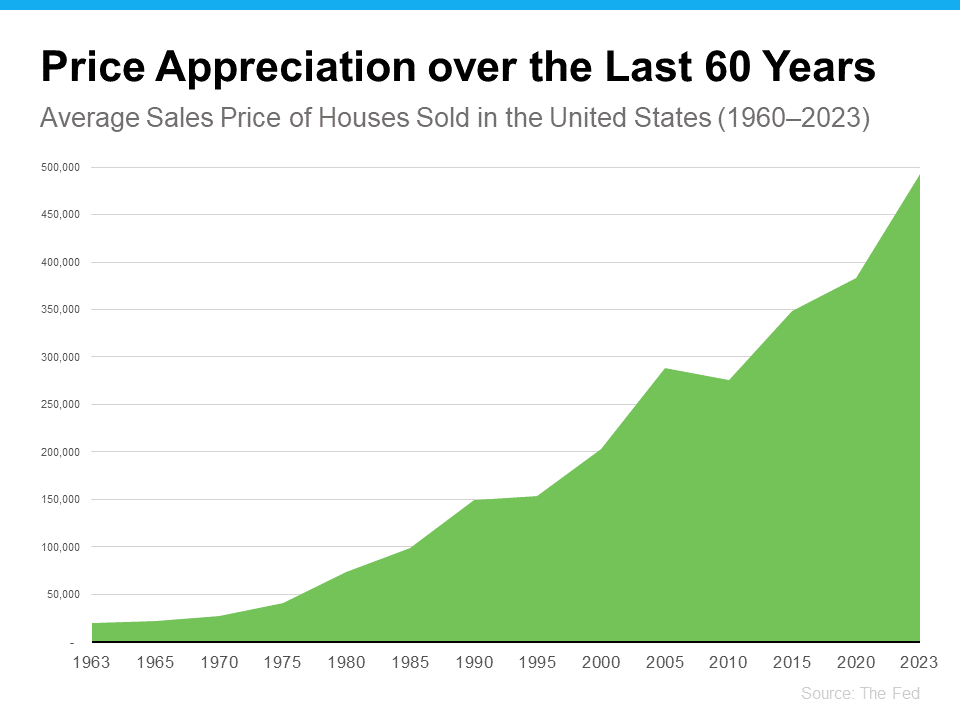

Appreciation of Home Values

Historically, home values tend to appreciate over time. While there might be fluctuations in the short term, the long-term trend typically sees an increase. This means that when you buy a home, you’re not just acquiring a place to live; you’re also investing in an asset that has the potential to grow in value. This appreciation can provide financial stability and potential profit if you decide to sell in the future.

Building Equity

Every mortgage payment you make contributes to building equity in your home. Equity is the difference between the market value of your property and the amount you owe on your mortgage. As you pay down your mortgage over time, your equity increases, providing you with a valuable asset that you can leverage for various purposes, such as home improvements, education expenses, or retirement funding. Additionally, owning a home can offer stability and peace of mind, as you have control over your living space and aren’t subject to the whims of landlords or rental market fluctuations (see graph below):

Using data provided by the Federal Reserve (the Fed), it’s evident that home prices have shown a consistent upward trend over the past six decades. Although there was a notable exception during the 2008 housing crash, where prices deviated from the typical pattern, the general trajectory has been one of continuous growth.

Using data provided by the Federal Reserve (the Fed), it’s evident that home prices have shown a consistent upward trend over the past six decades. Although there was a notable exception during the 2008 housing crash, where prices deviated from the typical pattern, the general trajectory has been one of continuous growth.

This overarching trend underscores a significant advantage of purchasing a home over renting. As home prices increase and you steadily pay off your mortgage, you are simultaneously building equity in your property. This accumulation of equity over time can substantially enhance your overall net worth.

The Urban Institute says: “Homeownership is critical for wealth building and financial stability.”

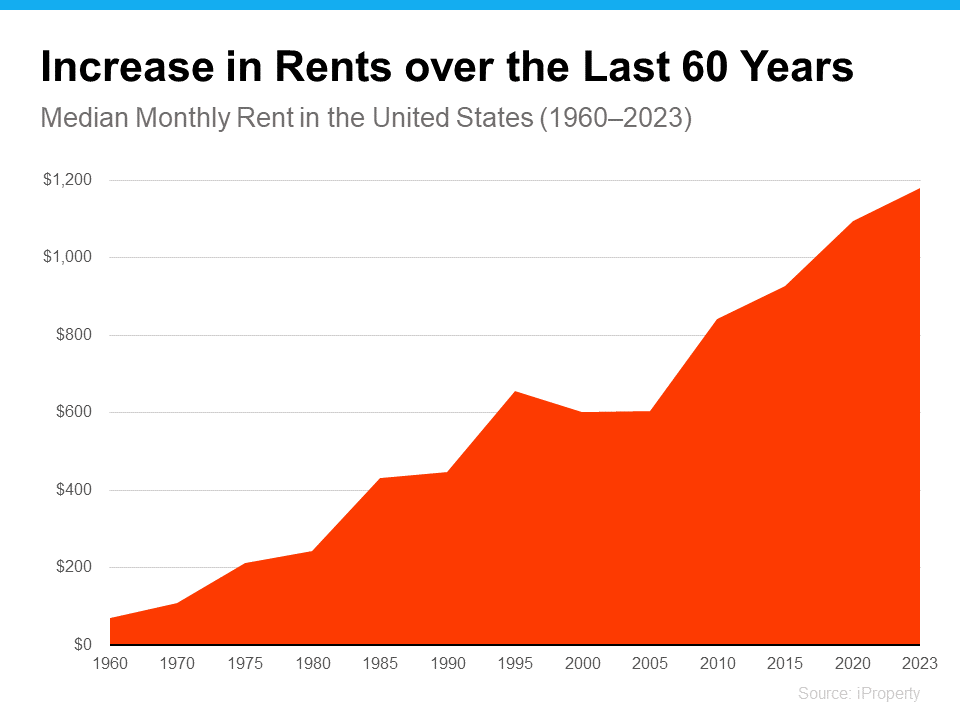

Rent Keeps Rising in the Long Run

Consider another compelling rationale for opting to purchase a home rather than renting: the persistent upward trajectory of rental costs over time. While renting may currently appear more affordable in certain regions, the reality is that with each lease renewal or signing, tenants often experience the burden of escalating rental fees. Research from iProperty Management reveals a consistent upward trend in rental prices over the past six decades. (see graph below):

So how do you escape the cycle of rising rents? Buying a home with a fixed-rate mortgage helps you stabilize your housing costs and say goodbye to those annoying rent increases. That kind of stability is a big deal.

Your housing payments are like an investment, and you’ve got a decision to make. Do you want to invest in yourself or keep paying your landlord?

When you own your home, you’re investing in your own future. And even when renting is cheaper, that money you pay every month is gone for good.

As Dr. Jessica Lautz, Deputy Chief Economist and VP of Research at the National Association of Realtors (NAR), says:

“If a homebuyer is financially stable, able to manage monthly mortgage costs and can handle the associated household maintenance expenses, then it makes sense to purchase a home.”

Bottom Line

If you’re tired of your rent going up and want to explore the many benefits of homeownership, let’s talk to explore your options.