The Dramatic Impact of Homeownership on Net Worth

If you’re grappling with the decision of whether to rent or purchase a home this year, here’s a compelling perspective that could provide the clarity and confidence required to make an informed choice.

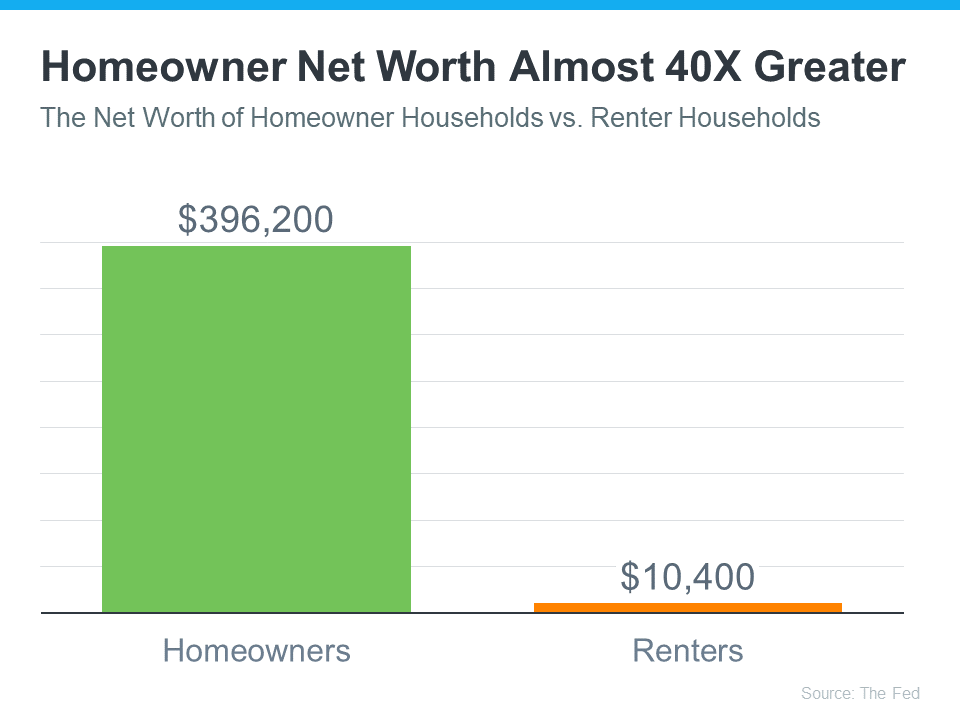

Every three years, the Federal Reserve releases the Survey of Consumer Finances (SCF), which compares net worth for homeowners and renters. The latest report shows the average homeowner’s net worth is almost 40X greater than a renter’s (see graph below):

A contributing factor to the wealth disparity between renters and homeowners lies in the homeownership experience. As a homeowner, your equity increases as your home appreciates in value and you consistently make mortgage payments. Homeownership facilitates a form of compulsory savings through monthly mortgage payments, ultimately leading to a financial gain when you choose to sell. In contrast, as a renter, the monthly rental payments do not result in any financial return. Ksenia Potapov, Economist at First American, explains it like this:

“Renters don’t capture the wealth generated by house price appreciation, nor do they benefit from the equity gains generated by monthly mortgage payments . . .”

The Largest Part of Most Homeowner Net Worth Is Their Equity

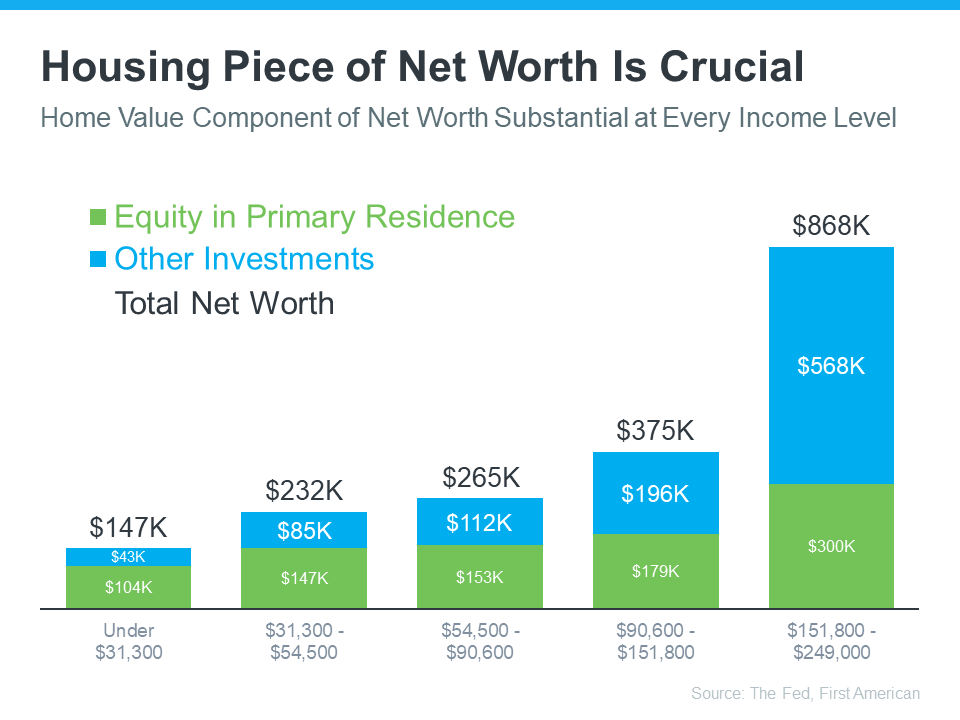

Home equity does more to build the average household’s wealth than anything else. According to data from First American and the Federal Reserve, this holds true across different income levels (see graph below):

The green segment in each bar represents how much of a homeowner’s net worth comes from their home equity. Based on this data, it’s clear no matter what your income level is, owning a home can really boost your wealth. Nicole Bachaud, Senior Economist at Zillow, shares:

“The biggest asset most people are ever going to own is a home. Homeownership is really that financial key that helps unlock stability and wealth preservation across generations.”

If you’re prepared to begin building your net worth, the present real estate market presents various opportunities worth exploring. For instance, recent declines in mortgage rates might enhance your purchasing capability compared to previous months. Additionally, the increasing inventory in the market provides a broader range of options for you to explore. Consulting with a local real estate agent can help you navigate the current opportunities and assist you in finding your perfect home.

Bottom Line

If you’re unsure about whether to rent or buy a home, keep in mind that owning a home can increase your overall wealth in the long run, no matter your income. To discover more about this and the many other benefits of homeownership, let’s connect.