Some Experts Say Mortgage Rates May Fall Below 6% Later This Year

There’s considerable confusion in the current mortgage rate landscape, but it’s crucial to understand that, in comparison to the nearly 8% peak last autumn, mortgage rates have generally decreased. This is significant for those considering buying or selling a home. Despite anticipated fluctuations influenced by various economic factors such as inflation and responses to the consumer price index (CPI), it’s important not to be swayed by short-term volatility. Experts concur that the overall downward trend in mortgage rates is expected to persist throughout this year.

While the exceptionally low rates seen during the pandemic may not be repeated, some analysts anticipate rates dropping below 6% later in the year. As Dean Baker, Senior Economist, Center for Economic Research, says:

“They will almost certainly not fall to pandemic lows, although we may soon see rates under 6.0 percent, which would be low by pre-Great Recession standards.”

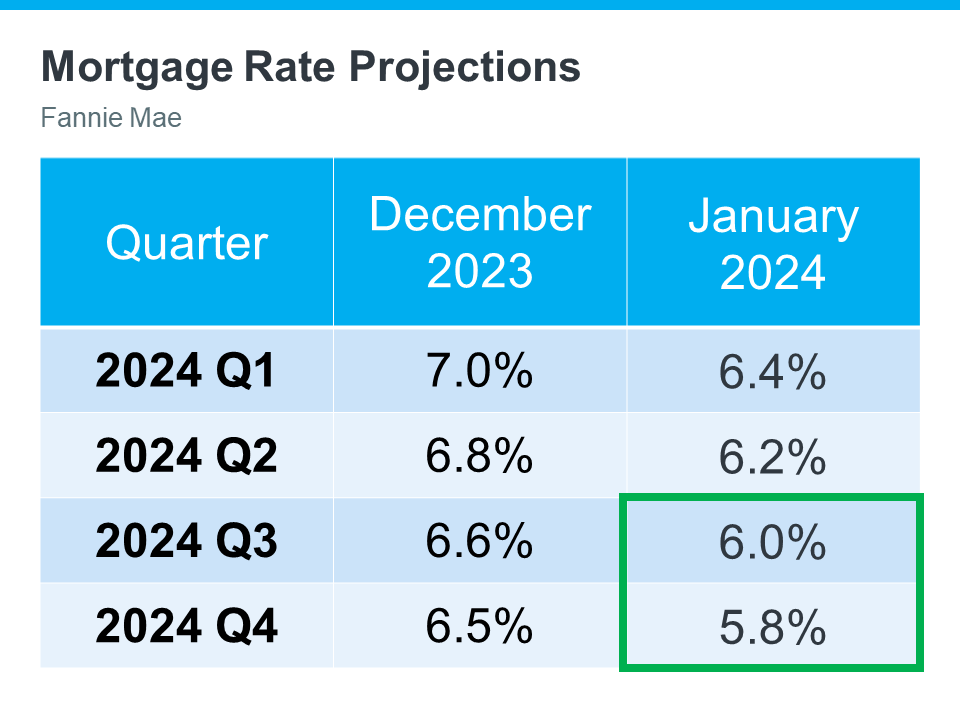

And Baker isn’t the only one saying this is a possibility. The latest Fannie Mae projections also indicate we may see a rate below 6% by the end of this year (see the green box in the chart below):

The graph illustrates Fannie Mae’s 2024 mortgage rate predictions, encompassing the December release and a subsequent updated forecast just a month later. A discerning observation reveals a downward trajectory in the projections. It is customary for experts to revise forecasts based on ongoing market trends and the overall economic landscape. This trend indicates that experts express confidence in the likelihood of continued rate decline, contingent on inflation moderating.

What This Means for You

However, it’s important to acknowledge that predicting future events, including their timing, is uncertain, and short-term market fluctuations are anticipated. Therefore, don’t be unduly alarmed by minor shifts; instead, focus on the broader perspective.

In today’s real estate market, especially where finding a home within your budget and meeting your requirements can be challenging, attempting to time the market and wait for rates to drop below 6% may not be advisable. Given that current rates are already lower than those in the previous fall, the present moment presents an opportunity. Even a modest quarter-point decrease in rates can enhance your purchasing power significantly.

Bottom Line

If you were considering a move last year but hesitated in anticipation of lower rates, the present moment might be the opportune time to take action. Feel free to reach out, and we can start the process rolling.