Advanced Search

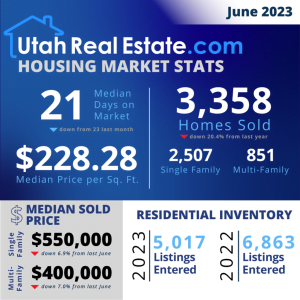

Here are the highlights from the latest Utah Housing Market statistics for June 2023. Mortgage interest rates are still having a profound effect on the Utah housing market. This is impacting the market in several ways: 1. Potential home sellers in Utah are reluctant to put their homes on the market and look for a new home, as they will be paying a higher interest rate on their new home. 2. Entry-level home buyers are struggling to qualify for a home mortgage due to the higher monthly loan payment and the high price being charged for available homes. 3. Potential move-up home buyers are also hesitant to move to a larger home where they will be paying more for their new home and also paying a higher interest rate.

- The Median Days on Market went down from May,

- Slightly fewer utah homes sold in June

- The median home price was down 6.9% from last June

- Inventory for Utah homes is down from last year

Bottom Line

If you are in the market for a new home, but are hesitant to move forward due to the higher rate on home mortgages, consider looking for a home with an assumable home mortgage. Finding a home with an assumable mortage will potentially save you thousands and thousands of dollars over the period of your mortgage.

We would be happy to provide a list of home with an assumable mortgage to help you find the home of your dreams.