Is Wall Street Buying Up All the Homes in America?

If you’re contemplating the purchase of a home, staying abreast of the latest real estate news is essential to understand the factors influencing your decision. You’ve likely come across discussions about investors and may be curious about their current impact on the housing market. This might prompt questions such as:

- How many homes do investors currently possess?

- Are major institutional players, such as large Wall Street firms, truly acquiring such a substantial number of homes that the average individual struggles to find one?

To address these inquiries, let’s delve into the factual account based on available data.

Firstly, it’s crucial to establish the total number of single-family homes (SFHs) and determine what percentage of these are under investor ownership. According to insights from SFR Investor, an organization specializing in the U.S. single-family rental market, there are currently eighty-two million single-family homes in the country. However, the key question is how many of these are actually rental properties.

Recent data reveals that sixty-eight million (82.93%) of these homes are owner-occupied, indicating that the homeowner resides in the property. Subtracting this figure from the total number of single-family homes (82 million) leaves approximately fourteen million homes designated as single-family rentals (SFRs).

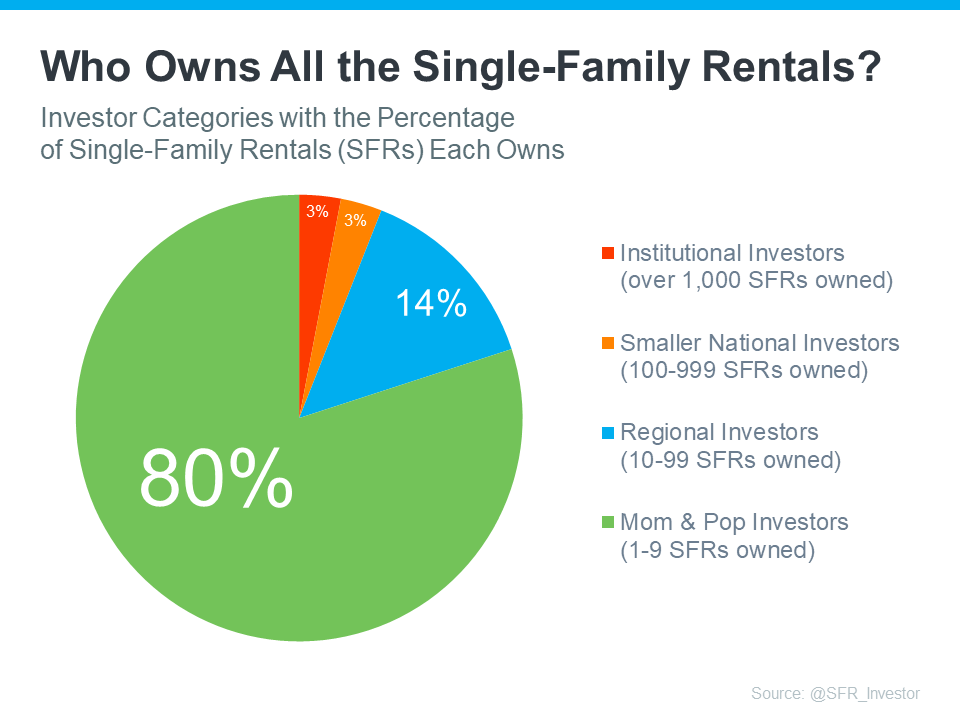

Now, do institutional investors exclusively own all of these remaining fourteen million homes? The answer is a resounding no. Let’s delve deeper into the investor landscape, which can be categorized into four groups:

- Mom & pop investors: Own between 1-9 SFRs

- Regional investors: Own between 10-99 SFRs

- Smaller national investors: Own between 100-999 SFRs

- Institutional investors: Own over 1,000 SFRs

These categories illustrate that not all investors fall into the large institutional bracket. To underscore this point further, here are the percentages of rental homes owned by each investor type (refer to the chart below):

As evident from the chart, contrary to the narratives presented in the news and on social media, the dominant portion, highlighted in green, is not under the ownership of large institutional investors. Rather, the majority is in the hands of small-scale mom & pop investors, individuals akin to your friends and neighbors.

The reality is that there are individuals, much like yourself, who strongly believe in the value of homeownership. They perceive purchasing a home, whether it’s a primary residence or a second property, as a strategic investment. Some might have identified an opportunity in the past few years to acquire a second home for rental purposes, creating an additional income stream. Others may have chosen to retain their initial home instead of selling it when upgrading to a new residence.

It’s important not to unquestioningly accept everything disseminated through news outlets or social media platforms concerning institutional investors. The notion that they are acquiring the majority of homes, thereby making it unattainable for the average person to buy, does not align with the actual statistics. In reality, institutional investors represent the smallest segment of the pie chart.

Bottom Line

While institutional investors do play a role in the single-family rental market, they are not monopolizing the entire housing market. If you have further inquiries or concerns about information circulating in the housing market, let’s connect so you can gain insights from an expert and obtain the necessary context.