Is It Better To Rent Than Buy a Home Right Now?

You may have seen reports in the news recently saying it’s more affordable to rent right now than it is to buy a home. And while that may be true in some markets if you just look at typical monthly payments, there’s one thing that the numbers aren’t factoring in: and that’s home equity. Here’s a look at how big of an impact equity can have and why it’s worth considering as you make your decision.

What the Headlines Are Based on

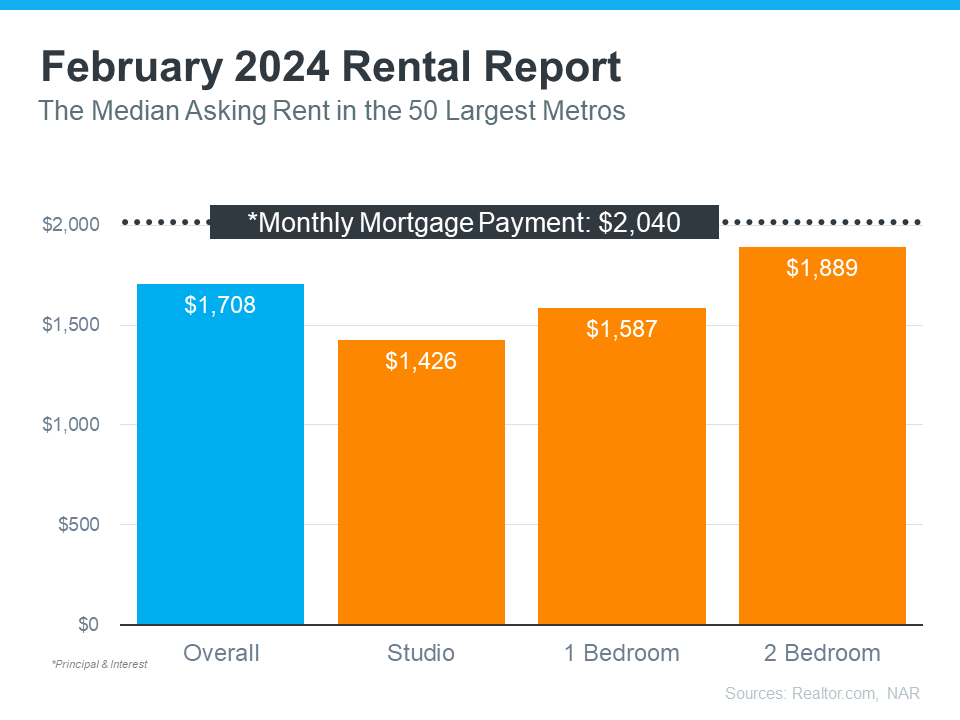

The graph below uses national data on the median rental payment from Realtor.com and median mortgage payment from the National Association of Realtors (NAR) to compare the two options. As the graph shows, especially if you’re not looking for a lot of space, it can be more affordable on a monthly basis to rent:

When seeking a home with two bedrooms, the contrast between the average rental cost and the typical mortgage payment begins to diminish, potentially making it a more feasible option. The median monthly mortgage installment stands at $2,040, while the median monthly rent for a two-bedroom dwelling amounts to $1,889–a difference of approximately $151 per month. However, when factoring in equity, the scenario undergoes a shift.

How Equity Changes the Game

If you opt for renting, your monthly payments solely cover your accommodation expenses and contribute to your landlord’s profits. Apart from potentially saving a bit more each month and the chance of reclaiming your rental deposit upon relocation, the money you allocate to housing each month disappears indefinitely.

However, purchasing a home means your monthly mortgage payment serves not only as shelter costs but also as an investment. This investment accrues equity as you consistently make mortgage payments, gradually reducing your home loan balance. Additionally, your equity receives a boost as property values typically appreciate over time.

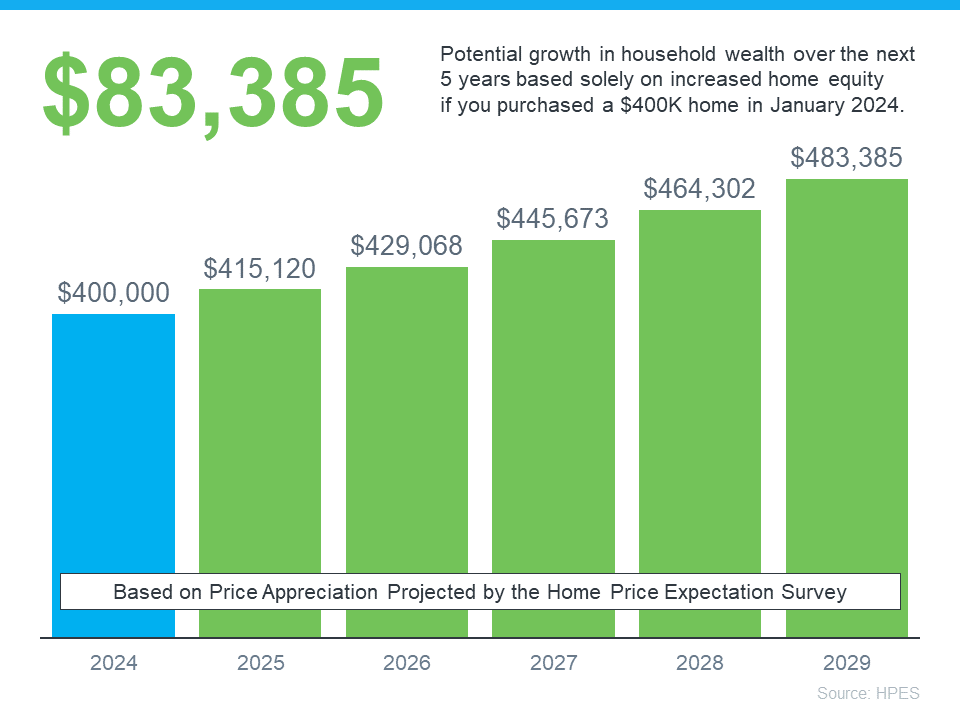

To illustrate how rapidly equity can accumulate, consider the following data. Fannie Mae and Pulsenomics release the findings of the Home Price Expectations Survey (HPES) quarterly. This survey gathers insights from over 100 economists, real estate professionals, and investment and market strategists regarding their predictions for home prices. According to the latest release, these experts anticipate a continuous increase in home prices over the next five years.

Here’s an example of how equity builds based on the projections from the HPES (see graph below):

Consider this scenario: you acquired a residence for $400,000 earlier this year with the intention of settling in for an extended period. According to the HPES forecasts, if you remain in the same home for five years, you stand to accumulate more than $83,000 in household wealth as your property appreciates.

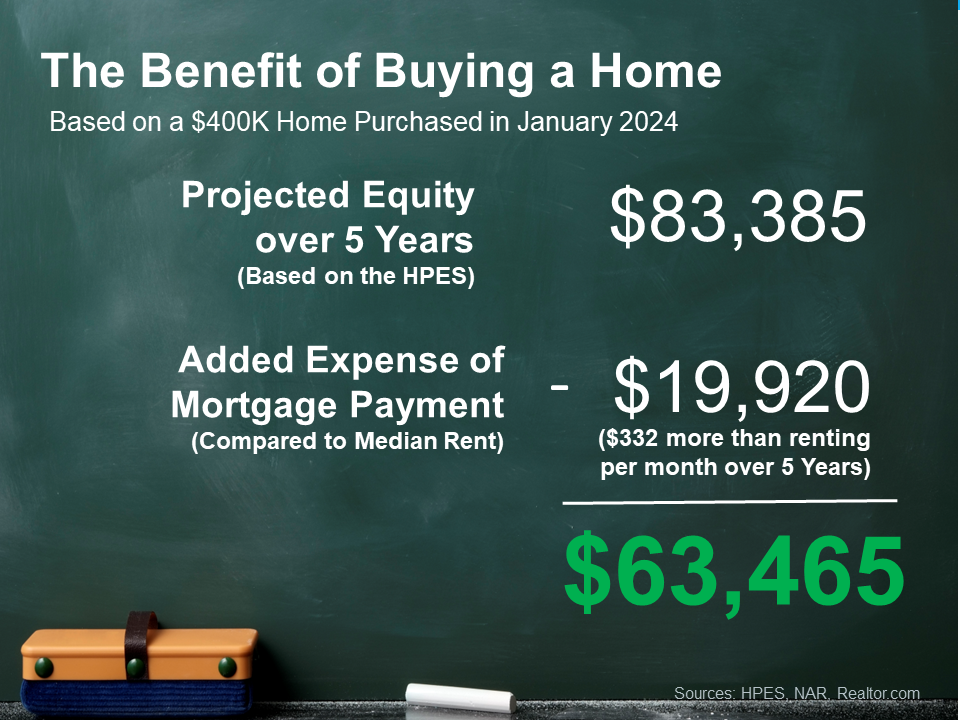

Now, let’s contrast this with renting, utilizing the previously mentioned median rent as a benchmark.

Although renting may offer some immediate savings on monthly expenses, it comes at the expense of forgoing the opportunity to build equity.

The key takeaway here is that the decision between renting and buying depends on your individual financial circumstances. It’s unwise to pursue a home purchase if the financial metrics don’t align with your situation. However, if you are financially prepared and capable, the prospect of accruing equity could be the decisive factor that convinces you buying is the better choice in the long term.

Bottom Line

When it comes down to it, buying a home gives you a benefit renting just can’t provide – and that’s the chance to gain equity. If you want to take advantage of long-term home price appreciation, let’s go over your options.