Foreclosure Activity Is Still Lower than the Norm

Have you come across news stories discussing the rise in foreclosures in the current real estate market? If you have, it might be causing some concern about what lies ahead. However, it’s important to note that sensational headlines don’t always provide the complete picture.

In reality, when you compare the present statistics to the typical market trends, there’s no reason to be alarmed.

Putting the Headlines into Perspective

Historical Data Shows There Isn’t a Wave of Foreclosures

Rather than juxtaposing current figures with the anomalies of recent years, a more prudent approach is to assess them against long-term trends, particularly those related to the housing crash, as that is the concern on people’s minds.

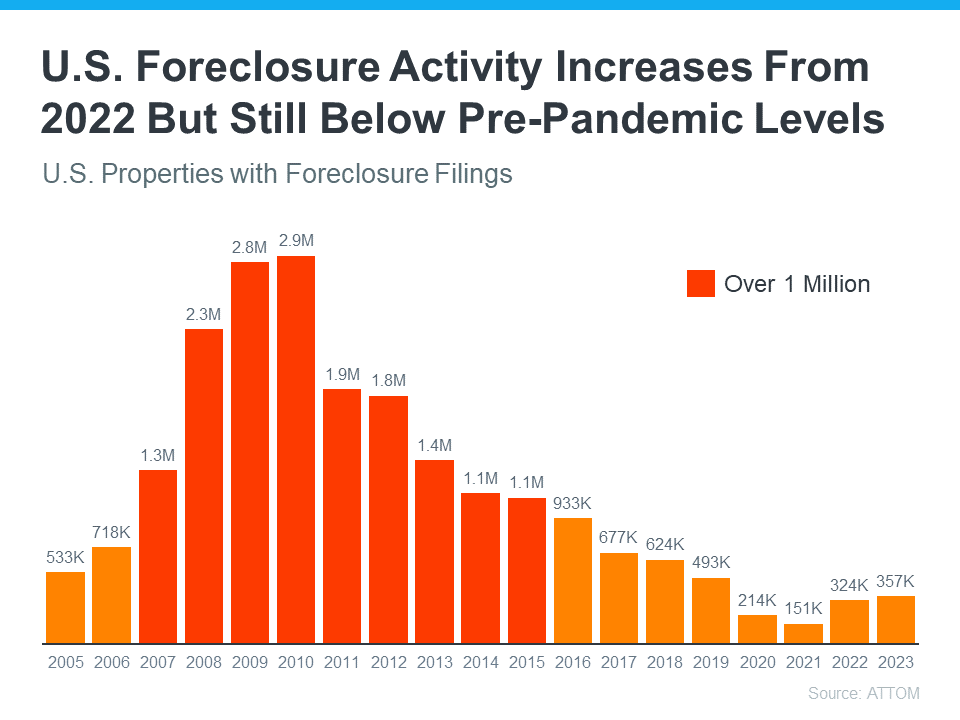

Examine the graph provided below, utilizing foreclosure data sourced from ATTOM, a property data provider. It illustrates a sustained decrease in foreclosure activity (shown in orange) since the housing crash in 2008 (shown in red):

So, while foreclosure filings are up in the latest report, it’s clear this is nothing like it was back then.

In fact, we’re not even back at the levels we’d see in more normal years, like 2019. As Rick Sharga, Founder and CEO of the CJ Patrick Company, explains:

“Foreclosure activity is still only at about 60% of pre-pandemic levels. . .”

That’s largely because buyers today are more qualified and less likely to default on their loans. Delinquency rates are still low and most homeowners have enough equity to keep them from going into foreclosure. As Molly Boesel, Principal Economist at CoreLogic, says:

“U.S. mortgage delinquency rates remained healthy in October, with the overall delinquency rate unchanged from a year earlier and the serious delinquency rate remaining at a historic low… borrowers in later stages of delinquencies are finding alternatives to defaulting on their home loans.”

The reality is, while increasing, the data shows a foreclosure crisis is not where the market is today, or where it’s headed.

Bottom Line

Even though the housing market is experiencing an expected rise in foreclosures, it’s nowhere near the crisis levels seen when the housing bubble burst. If you have questions about what you’re hearing or reading about the housing market, let’s connect.