Down Payment Assistance Programs Can Help Pave the Way to Homeownership

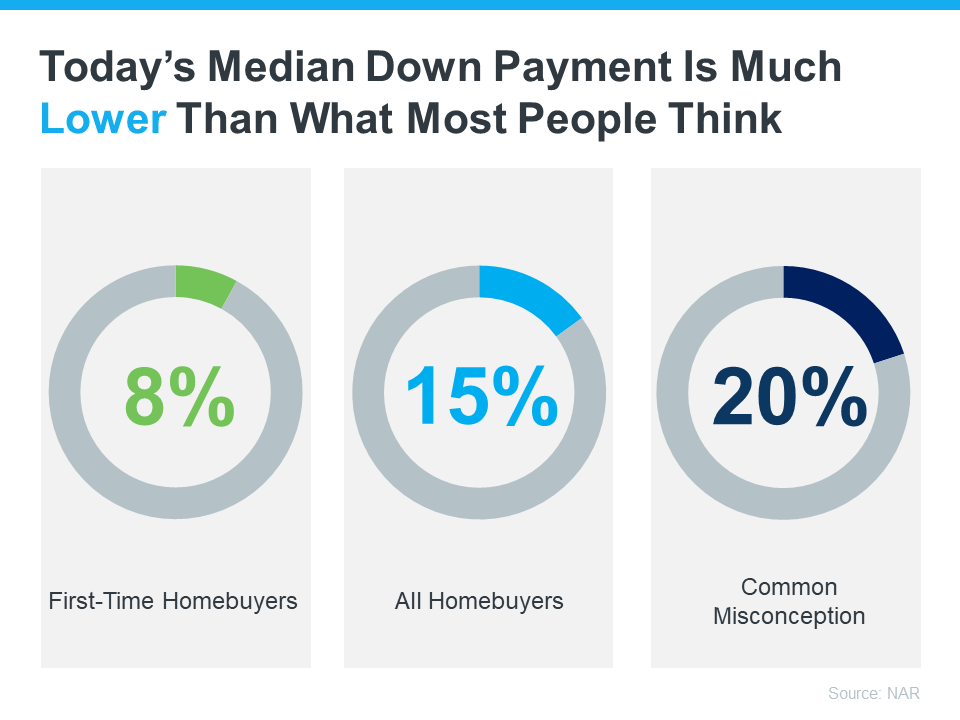

If you’re looking to buy a home, your down payment doesn’t have to be a big hurdle. According to the National Association of Realtors (NAR), 38% of first-time homebuyers find saving for a down payment the most challenging step. But the reality is, you probably don’t need to put down as much as you think:

According to data from the National Association of Realtors (NAR), the median down payment has not exceeded 20% since 2005. In the current landscape, the median down payment for all homebuyers stands at 15%, while first-time homebuyers typically contribute a lower percentage, averaging at 8%. However, it’s crucial to note that the median figure does not prescribe a mandatory down payment amount, and many eligible buyers opt for even lower down payments.

For instance, certain loan types, such as FHA loans, allow down payments as minimal as 3.5%. Additionally, alternatives like VA loans and USDA loans present opportunities for qualified applicants to secure financing without any down payment requirements. Beyond these loan options, it’s worth delving into another advantageous avenue that could assist in meeting your down payment needs: down payment assistance programs.

First-Time and Repeat Buyers Are Often Eligible

As indicated by Down Payment Resource, a multitude of homebuyer programs exists, with 75% of them categorized as down payment assistance initiatives. Importantly, eligibility extends beyond first-time homebuyers, encompassing individuals at various stages of their homebuying journey. Down Payment Resource highlights that more than 39% of homeownership programs are specifically tailored for repeat homebuyers with a recent homeownership history within the last three years.

Crucially, you need not limit your exploration of these programs based on your prior homeownership status. To initiate your quest for additional information, a reliable starting point is consulting with a trusted real estate professional. They possess the knowledge to provide insights into available options, including specialized programs catering to specific professions or communities.

Additional Down Payment Resources That Can Help

Several down payment assistance programs are aiding today’s homebuyers in achieving their homeownership aspirations:

- Teacher Next Door: This initiative is tailored to assist teachers, first responders, healthcare providers, government employees, active-duty military personnel, and veterans in reaching their down payment objectives.

- Fannie Mae: Providing down-payment assistance specifically for eligible first-time homebuyers residing in predominantly Latino communities.

- Freddie Mac: Offering options designed for homebuyers with modest credit scores and limited funds for a down payment.

- 3By30 Program: This program outlines actionable strategies with the goal of adding 3 million new Black homeowners by 2030. These initiatives provide valuable resources to potential buyers, simplifying the process of securing down payments and turning their homeownership dreams into reality.

- Down Payment Resource for Native Americans: Highlighting 42 U.S. homebuyer assistance programs across 14 states, this resource facilitates the journey to homeownership for Native Americans by providing support with down payments and associated costs.

Even if eligibility criteria are not met for these specific programs, there are numerous other federal, state, and local options worth exploring. A real estate professional can prove invaluable in guiding you towards options that align with your needs as you navigate the available resources.

Bottom Line

Achieving the dream of having a home may be more within reach than you think, especially when you know where to find the right support. To learn more about your options, let’s connect.