Bridging the Gaps on the Road to Homeownership

Owning a home is a significant aspect of the American Dream, yet attaining this goal can pose considerable challenges. Despite efforts to enhance fair housing access, households of color encounter distinctive obstacles on their journey to home ownership. Collaborating with knowledgeable real estate professionals can significantly impact the experience for diverse buyers.

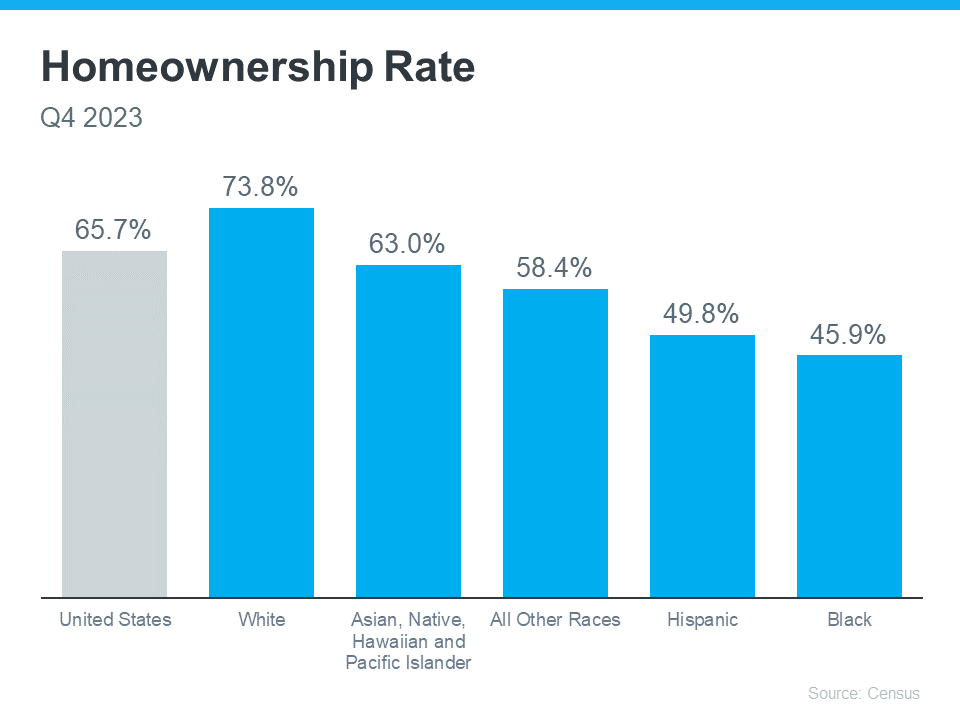

It is evident that certain groups face greater difficulties in achieving homeownership, as there remains a noticeable disparity between the overall average U.S. homeownership rate and that of non-white groups. Presently, Black households maintain the lowest homeownership rate on a national scale (see graph below):

Owning a home plays a vital role in establishing household wealth that can be bequeathed to successive generations. A study conducted by the National Association of Realtors (NAR) reveals that nearly half of Black homebuyers in 2023 were embarking on their first home purchase. This indicates that a significant portion of these buyers lacked the advantage of pre-existing home equity to contribute towards their home acquisition.

This financial obstacle in itself adds complexity to the homebuying process, particularly during a period when affordability is a prominent issue for those entering the housing market for the first time. Jessica Lautz, Deputy Chief Economist at NAR says:

“It’s an incredibly difficult market for all home buyers right now, especially first-time home buyers and especially first-time home buyers of color.”

Because of these challenges, there are several down payment assistance programs specifically aimed at helping minority buyers fulfill their homeownership dreams:

- The 3By30 program offers valuable resources for Black buyers, making it easier for them to secure a down payment and buy a home.

- For Native Americans, Down Payment Resource highlights 42 U.S. homebuyer assistance programs across 14 states that make homeownership more attainable by providing support with down payments and other costs.

- Fannie Mae provides down payment assistance to eligible first-time homebuyers living in Latino communities.

Even if you do not meet the eligibility criteria for these programs, numerous alternative federal, state, and local options are available for exploration. A real estate professional can assist you in identifying the ones that align most effectively with your requirements.

For minority homebuyers, the persisting challenges can evoke feelings of distress and frustration. Hence, it becomes crucial for individuals from diverse groups to have a proficient team of experts supporting them during the homebuying journey. These professionals not only serve as seasoned advisors with a comprehensive understanding of the market, offering optimal guidance, but also act as empathetic educators who advocate for your best interests at every stage of the process.

Bottom Line

Let’s connect to make sure you have the information and support you need as you walk the path to homeownership.