What Every Homeowner Should Know About Their Equity

What Every Homeowner Should Know About Their Equity

Curious About Selling Your Home? Understanding Your Home Equity is the First Step

If you’re considering selling your home, understanding how much equity you have is essential. With the rise in home prices over the past few years, many homeowners may have more equity than they realize.

Home Equity: What Is It and How Much Do You Have?

Home equity is the difference between your home’s market value and the outstanding balance on your mortgage. For example, if your home is worth $400,000 and your remaining mortgage balance is $200,000, your equity would be $200,000.

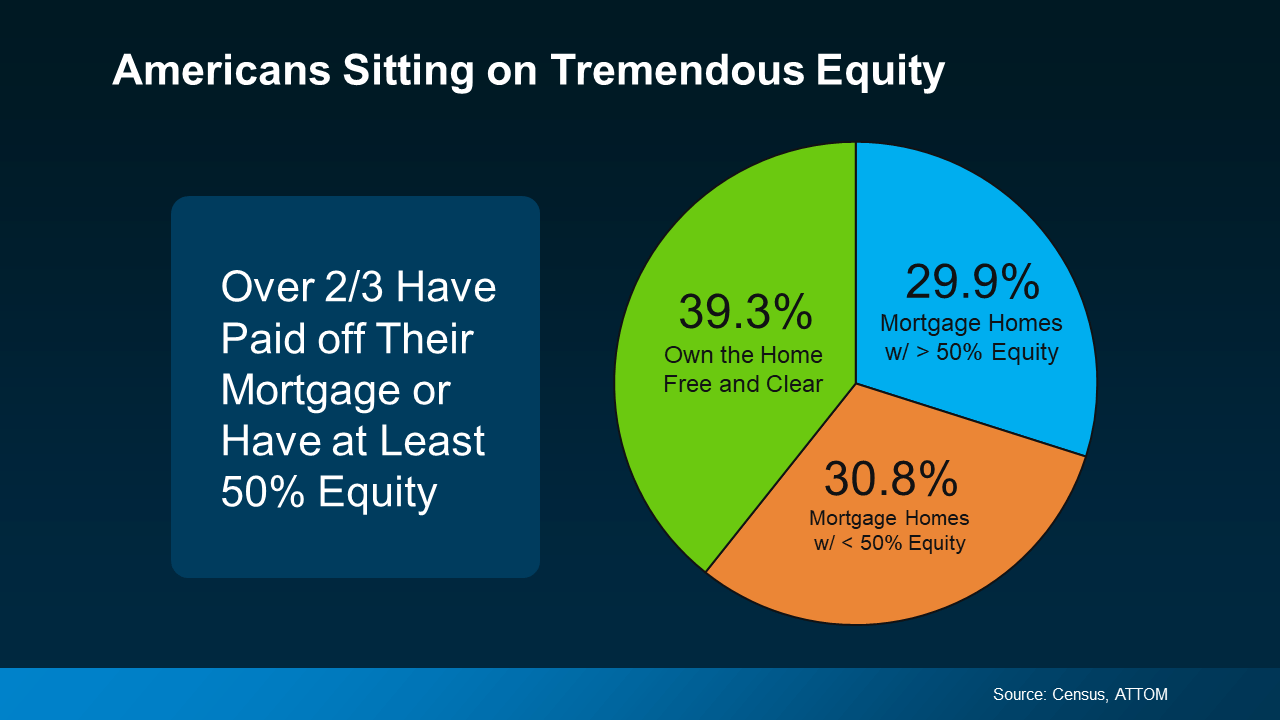

Recent data from the Census and ATTOM indicate that Americans currently have substantial home equity. More than two-thirds of homeowners have either fully paid off their mortgages or have at least 50% equity in their homes (shown in blue in the chart below):

Today’s Homeowners Are Seeing Bigger Returns on Their Investments

More homeowners today are enjoying substantial returns on their home investments when they sell. If you have significant equity, it can be a powerful asset for your next move.

Next Steps

If you’re considering selling your home, it’s crucial to understand how much equity you have and what that means for your sale and potential earnings. The best way to get a comprehensive understanding is to work with your real estate agent and consult with a tax professional or financial advisor. This team of experts can help you navigate your specific situation and provide guidance.

Bottom Line

Rising home prices likely mean an increase in your home equity as well. Let’s connect to determine how much equity you have and help you move forward with confidence when you decide to sell.