Questions You May Have About Selling Your House

Mortgage rates are undeniably influencing the current housing market. This might raise some questions about whether it’s still a good idea to sell your house and relocate.

Here are three of the most common questions you might have, along with the data to help answer them.

1. Should I Wait To Sell?

If you’re considering waiting to sell your home until mortgage rates decrease, many others may have the same idea.

Although mortgage rates are predicted to decline later this year, waiting could mean facing significantly more competition from other buyers and sellers re-entering the market.

As Bright MLS says:

“Even a modest drop in rates will bring both more buyers and more sellers into the market.”

That means if you wait it out, you’ll have to deal with things like prices rising faster and more multiple-offer scenarios when you buy your next home.

2. Are Buyers Still Out There?

However, this doesn’t mean that no one is moving at the moment. While some individuals are postponing their plans, there are still numerous active buyers today. The data supports this.

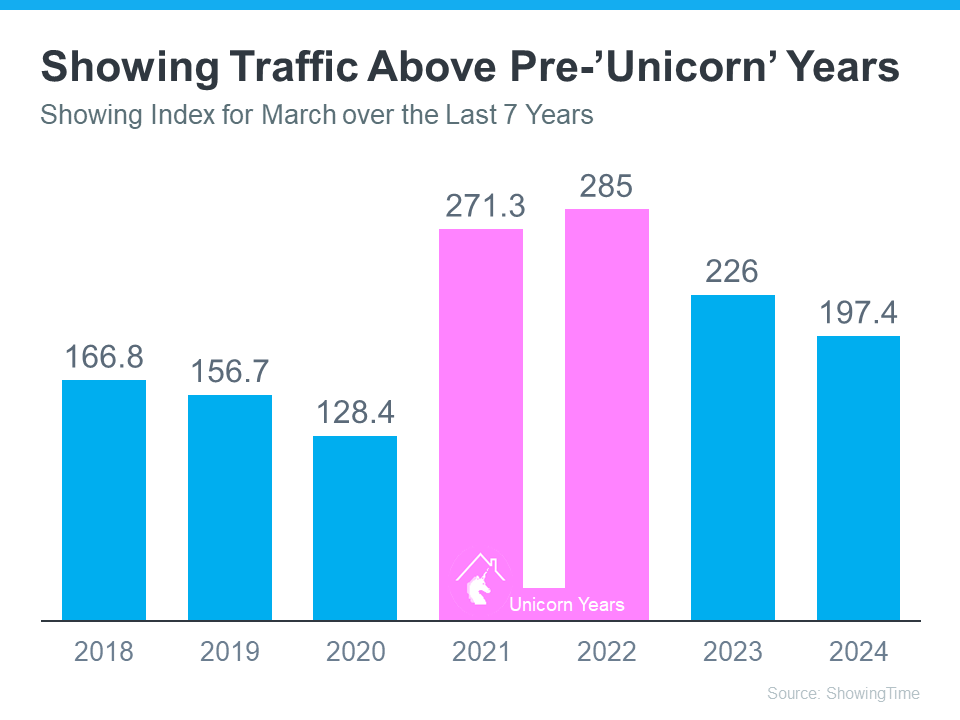

The ShowingTime Showing Index measures the frequency of home tours by buyers. The graph below illustrates buyer activity for March (the most recent data available) over the past seven years:

You can see that demand has decreased somewhat since the ‘unicorn’ years (highlighted in pink). This decline is due to various market factors, such as higher mortgage rates, increasing prices, and limited inventory. To truly grasp today’s demand, it’s essential to compare our current situation with the last normal years in the market (2018-2019) rather than the exceptional ‘unicorn’ years.

Focusing on the blue bars provides insight into how 2024 compares, offering a fresh perspective.

Nationally, demand is still high compared to the last normal years in the housing market (2018-2019). And that means there’s still a market for your house to sell.

3. Can I Afford To Buy My Next Home?

If you’re concerned about affording your next move with today’s rates and prices, consider that you will likely have more equity in your current home than you realize.

Homeowners have accumulated record amounts of equity in recent years. This equity can significantly impact your ability to purchase your next home. You might even have enough to buy your next home outright with cash, avoiding the need for a mortgage altogether.

As Jessica Lautz, Deputy Chief Economist at the National Association of Realtors (NAR), says:

“ . . . those who have earned housing equity through home price appreciation are the current winners in today’s housing market. One-third of recent home buyers did not finance their home purchase last month—the highest share in a decade. For these buyers, interest rates may be less influential in their purchase decisions.”

Bottom Line

If you’ve been grappling with these three questions and they’ve been deterring you from selling, hopefully, this information helps. According to a recent survey from Realtor.com, over 85% of potential sellers have been contemplating selling for more than a year. This means there are many sellers like you who are uncertain.

However, the same survey also interviewed recent sellers who decided to list their homes, and 79% of them wish they had sold sooner.

If you want to discuss any of these questions further or need more information, let’s connect.