What Mortgage Rate Do You Need To Move?

If you’re considering purchasing a home, the current mortgage rates are likely a significant consideration. In fact, they might be the reason behind your decision to postpone your plans temporarily. Last year, when rates approached 8%, many potential buyers discovered that the figures no longer aligned with their budget, leading them to reconsider their home-buying plans. It’s possible that you find yourself in a similar situation.

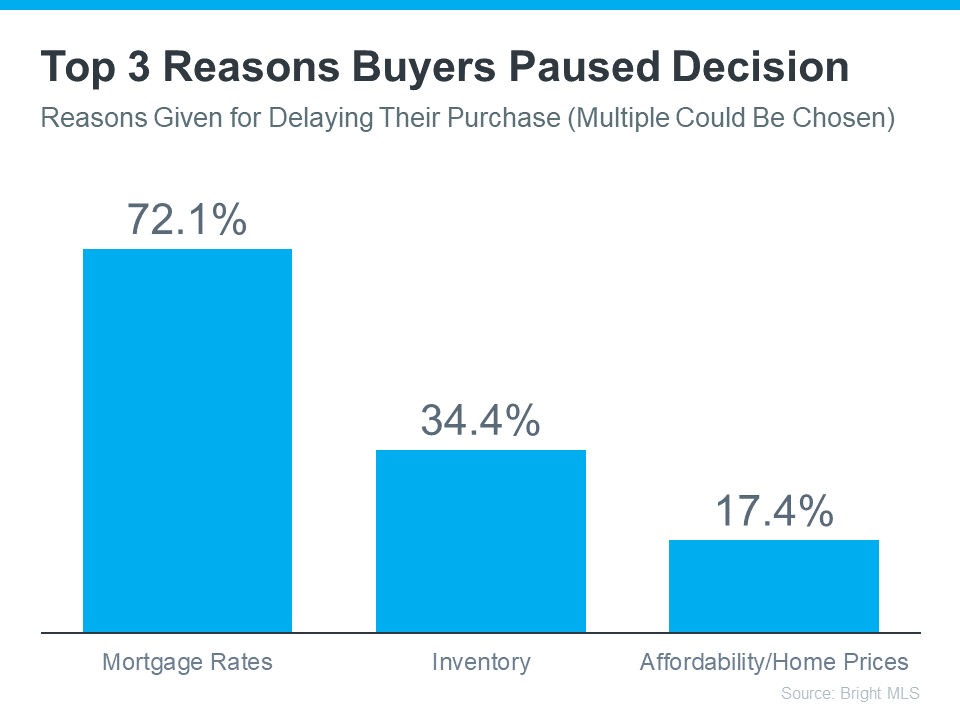

Data from Bright MLS shows the top reason buyers delayed their plans to move is due to high mortgage rates (see graph below):

David Childers, CEO at Keeping Current Matters, speaks to this statistic in the recent How’s The Market podcast:

“Three quarters of buyers said ‘we’re out’ due to mortgage rates. Here’s what I know going forward. That will change in 2024.”

This is due to the fact that mortgage rates have decreased from their peak in October. Although there remains some day-to-day fluctuation in rates, the extended forecasts indicate a potential continued decline throughout the year, provided inflation is effectively managed. Knowledgeable sources suggest the possibility of rates falling below 6% by the conclusion of 2024. Such a scenario could be a significant game-changer for numerous prospective buyers. As a recent article from Realtor.com says:

“Buying a home is still desired and sought after, but many people are looking for mortgage rates to come down in order to achieve it. Four out of 10 Americans looking to buy a home in the next 12 months would consider it possible if rates drop below 6%.”

Predicting mortgage rates is a challenging task, but the positive outlook from experts offers valuable insights into future trends. If your plans were put on hold, there’s renewed optimism, signaling that it might be the opportune moment to reconsider and plan your next move. The best question you can ask yourself right now, is this:

What number do I want to see rates hit before I’m ready to move?

The specific percentage at which you feel ready to resume your home search is a personal decision. It could be 6.5%, 6.25%, or even when they fall below 6%. Once you determine that threshold, take the next step by reaching out to a local real estate professional. They will keep you updated on market developments, and as soon as rates align with your target, they’ll be the first to inform you.

Bottom Line

If you’ve postponed your relocation plans due to current mortgage rates, consider determining the specific rate that would prompt you to reconsider entering the market. Once you identify that target rate, let’s get in touch so that you have a reliable ally keeping you informed and notifying you when we reach that point.