Are More Homeowners Selling as Mortgage Rates Come Down?

If you’re in the market for a new home, the recent decline in mortgage rates brings positive news as it enhances affordability. Additionally, this trend may encourage more homeowners to consider selling their properties.

The Mortgage Rate Lock-In Effect

In the last year, a significant factor restricting your relocation choices has been the limited availability of homes on the market. This is due to a considerable number of homeowners postponing their selling plans in response to the increase in mortgage rates. An article from Freddie Mac explains:

“The lack of housing supply was partly driven by the rate lock-in effect. . . . With higher rates, the incentive for existing homeowners to list their property and move to a new house has greatly diminished, leaving them rate locked.”

These homeowners decided to stay put and keep their current lower mortgage rate, rather than move and take on a higher one on their next home.

Early Signs Show Those Homeowners Are Ready To Move Again

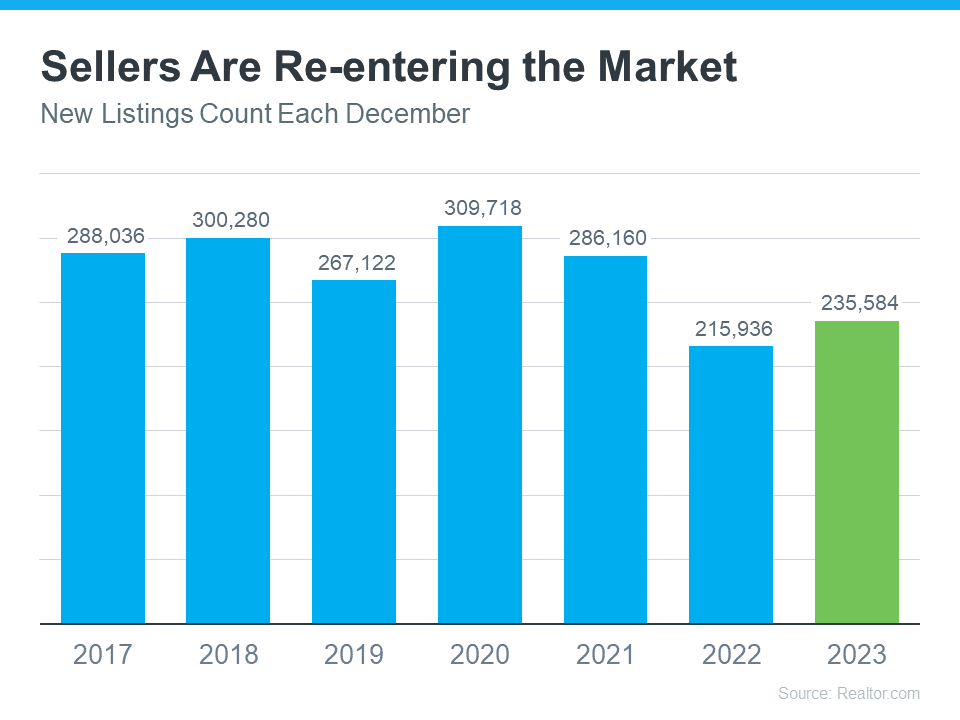

Based on the most recent data provided by Realtor.com, there was an increase in the number of homeowners listing their properties for sale, referred to as new listings, in December 2023 compared to the same month in 2022 (see graph below):

This holds significant importance for a specific reason. Normally, the housing market experiences a slowdown in activity during the latter months of the year, with some sellers opting to postpone their moves until the arrival of January.

This is the first time since 2020 that we’re seen an uptick in new listings this time of year. This could be a signal that the rate lock-in effect is easing a bit in response to lower rates.

What This Means for You

While there isn’t going to suddenly be an influx of options for your home search, it does mean more sellers may be deciding to list. According to a recent article from the Joint Center for Housing Studies (JCHS):

“A reduction in interest rates could alleviate the lock-in effect and help lift homeowner mobility. Indeed, interest rates have recently declined, falling by a full percentage point from October to November 2023 . . . Further decreases would reduce the barrier to moving and give homeowners looking to sell a newfound sense of urgency . . .”

And that means you may see more homes come onto the market to give you more fresh options to choose from.

Bottom Line

With the decrease in mortgage rates, there’s a possibility of more sellers rejoining the market, presenting you with an opportunity to discover your desired home. Let’s connect so you have a local expert by your side to keep you informed about the newest listings in our area