How To Turn Homeownership into a Side Hustle

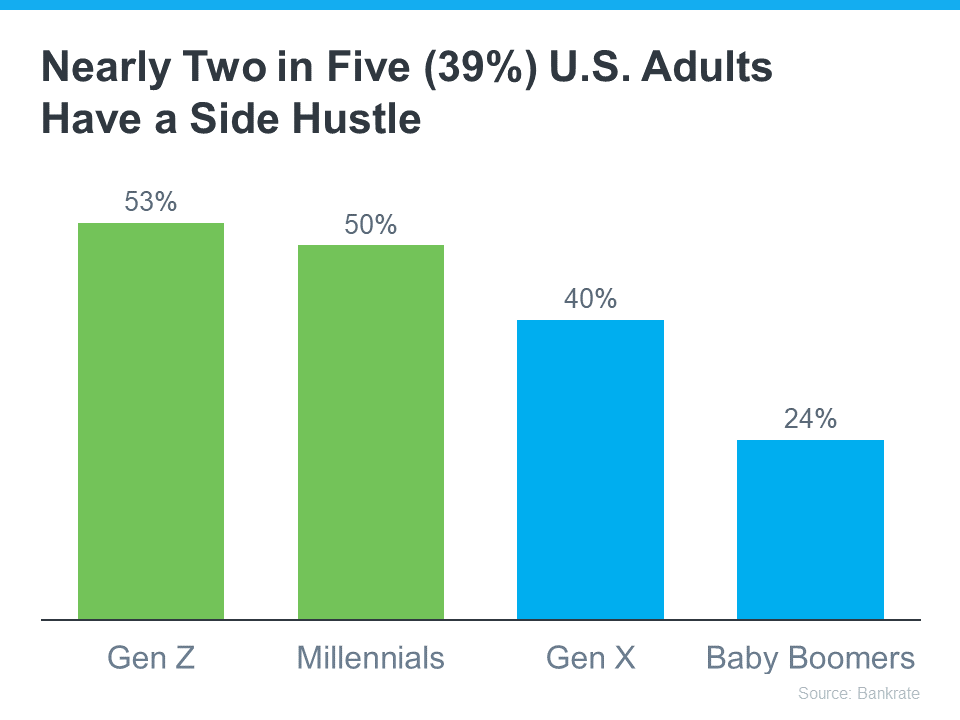

Is the escalating expense of nearly everything in today’s world dampening your aspirations of homeownership? Bankrate reports a growing number of individuals are exploring supplementary sources of income through side hustles, potentially in response to the mounting costs and to bolster savings for a home. This phenomenon is especially prevalent among younger individuals, possibly grappling with student loan debt (refer to the graph below.)

Here are two strategies that can not only make homeownership more affordable in the short term, but turn it into a lucrative side hustle that can pay off down the road.

Transforming the Challenge of a Fixer-Upper into an Opportunity

Consider exploring the option of purchasing a fixer-upper as a strategic move to facilitate your entry into homeownership. A fixer-upper refers to a property that may have lingered on the market longer than usual due to its less appealing condition. According to a recent article by U.S. News:

“In light of the current state of the housing market, expanding your search to include homes that require some updating and TLC might be a prudent approach to finding an affordable option. Opting for a fixer-upper, in contrast to move-in ready homes that quickly leave the market, could present a viable alternative.”

Choosing a property in need of some renovation can yield two significant advantages. Firstly, it may simplify your search process as you’re not fixated on finding the perfect home. Additionally, it could allow you to enter the housing market at a lower price point, providing a more financially feasible path to homeownership with the potential for future profits.

While it’s true that a fixer-upper may demand some elbow grease, the investment of time and effort into gradually improving the property not only transforms it into a personalized home but also enhances its future market value. As you relish the satisfaction of turning a house into a home, you are concurrently building equity that can be realized when the time comes to sell.

Renting Out a Portion of Your Home To Make It More Affordable

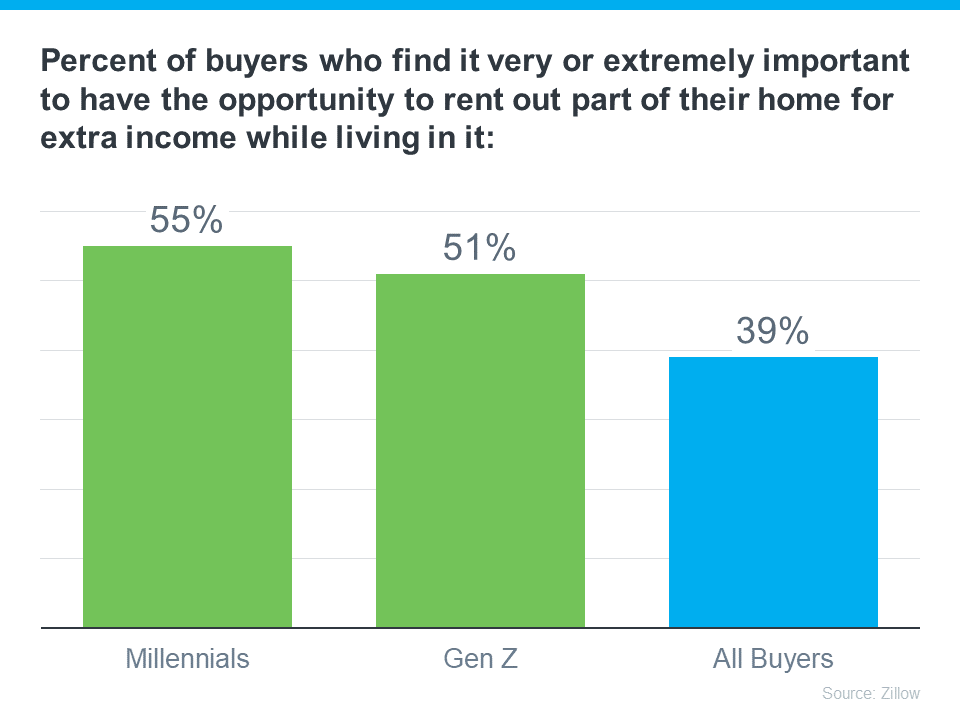

Another savvy strategy is to purchase a home with the upfront intention of renting out a portion of it. According to a recent press release from Zillow, renting out a part of their home is already very important for most young homebuyers (see graph below):

This strategy fulfills a significant role, as noted by Manny Garcia, Senior Population Scientist at Zillow:

“For individuals entering the realm of ‘side hustle culture,’ where traditional 9-to-5 employment might fall short of realizing homeownership aspirations, leveraging rental income can come to the rescue.”

Essentially, it can assist you in meeting your monthly mortgage obligations. Therefore, if you are receptive to the idea, leasing out a section of your home not only contributes to affordability but also transforms your residence into an investment, positioning you as an income generator.

Bottom Line

In the face of today’s affordability challenges, both of these strategies offer more attainable paths to homeownership, especially for younger buyers. If you want to discuss these options and see how they might play out for you in our local market, let’s connect.