3 Key Factors Affecting Home Affordability

Over the last year, considerable discussion has revolved around the issue of housing affordability and the challenges it poses. However, a recent development has provided some relief in this regard. Mortgage rates have experienced a decline since reaching their peak in October. Yet, gauging the affordability of owning a home involves considering factors beyond just mortgage rates.

A comprehensive understanding of home affordability necessitates an examination of three crucial elements: mortgage rates, home prices, and wages. Delving into the most recent data for each component will shed light on the reasons behind the improvement in affordability.

1. Mortgage Rates

Mortgage rates have come down in recent months. And looking forward, most experts expect them to decline further over the course of the year. Jiayi Xu, an economist at Realtor.com, explains:

“While there could be some fluctuations in the path forward … the general expectation is that mortgage rates will continue to trend downward, as long as the economy continues to see progress on inflation.”

Even a minor fluctuation in mortgage rates can have a significant influence on your purchasing power, potentially increasing your ability to afford your desired home through a reduction in your monthly mortgage payment.

2. Home Prices

The second pivotal factor is home prices. Following a fairly standard increase last year, projections indicate a continued moderate rise in 2024. This is attributed to the fact that, despite a slight anticipated growth in inventory this year, the supply of homes for sale remains insufficient to meet the demand from prospective buyers. According to Lisa Sturtevant, Chief Economist at Bright MLS:

“More inventory will be generally offset by more buyers in the market. As a result, it is expected that, overall, the median home price in the U.S. will grow modestly . . .”

This is great news for you, indicating that prices are unlikely to surge dramatically as they did during the pandemic. However, it also implies that delaying your purchase may result in higher costs. If you are prepared, eager, and financially capable of buying, seizing the opportunity before additional buyers enter the market and drive prices higher could be an advantage for you.

3. Wages

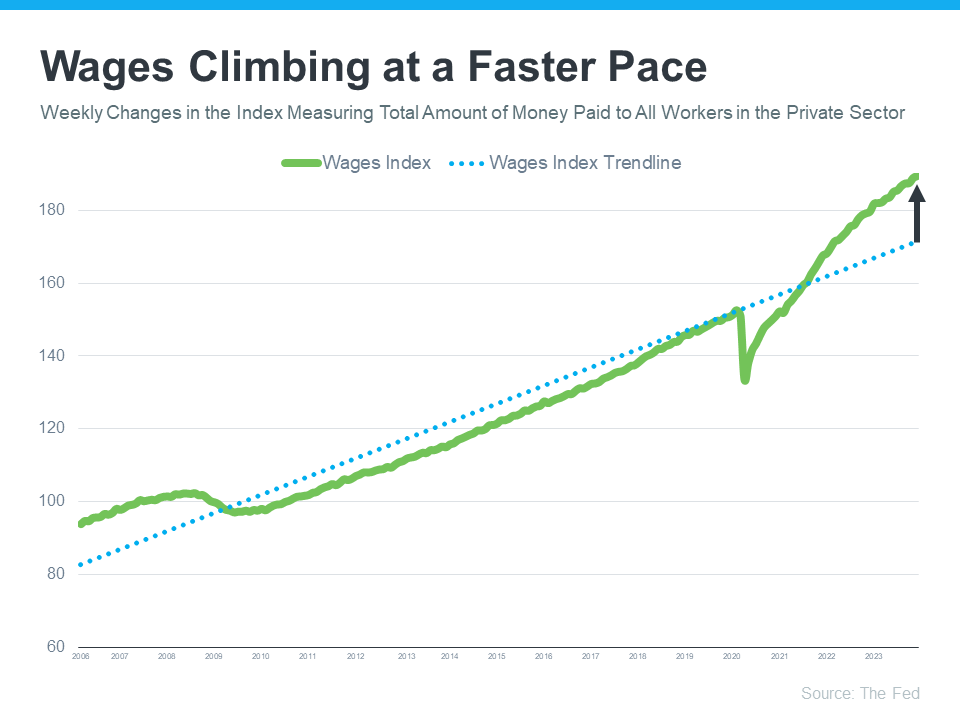

Another positive factor in affordability right now is rising income. The graph below uses data from the Federal Reserve to show how wages have grown over time:

Observing the blue dotted trendline, you’ll notice the usual pace at which wages tend to increase. However, on the graph’s right side, current wages surpass the trendline, indicating an accelerated growth rate.

Elevated wages contribute to improved affordability by lowering the percentage of your income required to cover your mortgage. This is due to the fact that you won’t need to allocate as much of your paycheck towards your monthly housing expenses.

What This Means for You

Home affordability depends on three things: mortgage rates, home prices, and wages. The good news is, they’re moving in a positive direction for buyers overall.

Bottom Line

If you’re thinking about buying a home, it’s important to know the main factors impacting affordability are improving. To get the latest updates on each, let’s connect.